In the ever-evolving landscape of the US housing market, recent trends have stirred up significant buzz and speculation. Join us as we delve into the latest developments shaping the industry and uncover the factors driving the recent downturn in housing starts and sales.

A Closer Look at Housing Starts

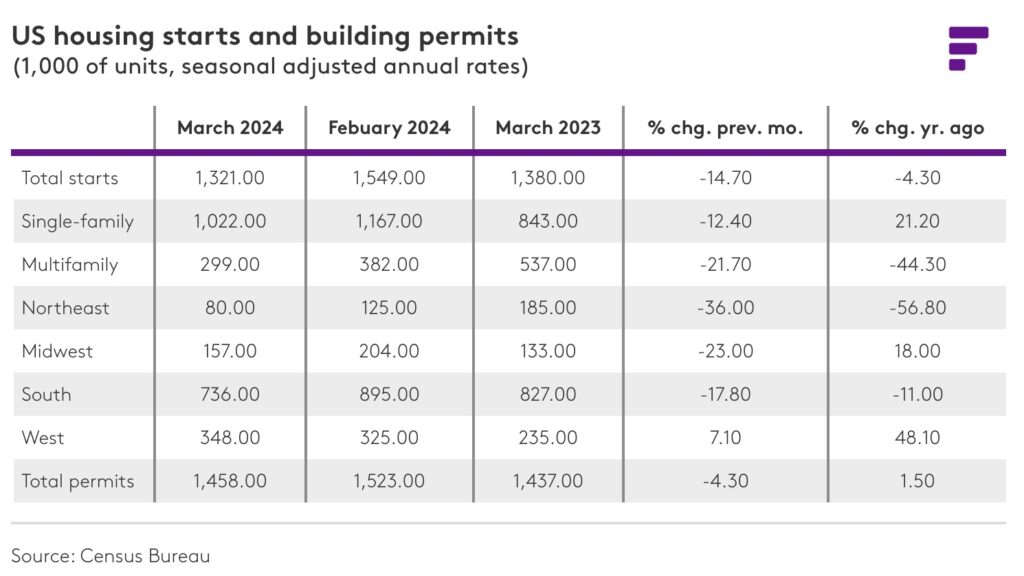

The latest data reveals a notable decline in US housing starts, with a staggering 14.7% drop in March alone. This downturn, fueled by persistently sticky mortgage interest rates and a lack of movement from the Federal Reserve, has raised eyebrows and sparked discussions among industry experts.

While single-family starts remain relatively strong, the multifamily sector has faced pronounced weakness, experiencing a notable 21.7% decline last month. Analysts expressed surprise at the continued downward trend, attributing it to various economic factors and market dynamics.

Impact of Mortgage Rates

One of the key drivers behind the housing market’s recent struggles is the significant increase in mortgage rates. US mortgage rates have soared to new heights this year, surpassing the 7% mark for the first time. This sharp uptick has left potential homebuyers grappling with tough decisions, as they weigh the urgency of purchasing against the looming threat of even higher rates in the future.

The 30-year fixed-rate mortgage, a widely watched indicator, climbed from 6.88% to 7.10% in late April, marking a significant shift in the mortgage landscape. With rates trending higher, many buyers are left wondering whether to act now or wait in hopes of more favorable conditions down the line.

Regional Disparities and Complex Challenges

The housing market’s challenges extend beyond national averages, with regional disparities adding another layer of complexity. While the West sees a slight uptick in housing starts, other regions, including the Midwest and Northeast, face declines. This divergence underscores the nuanced nature of the market and the importance of understanding local dynamics.

Navigating these challenges requires a keen understanding of the market’s intricacies and a proactive approach to adapting to changing conditions. From inflation and high interest rates to regional disparities and supply-side challenges, industry professionals and investors must stay informed and agile to thrive in this dynamic environment.

Impact on the Triangle

image for the full report in PDF

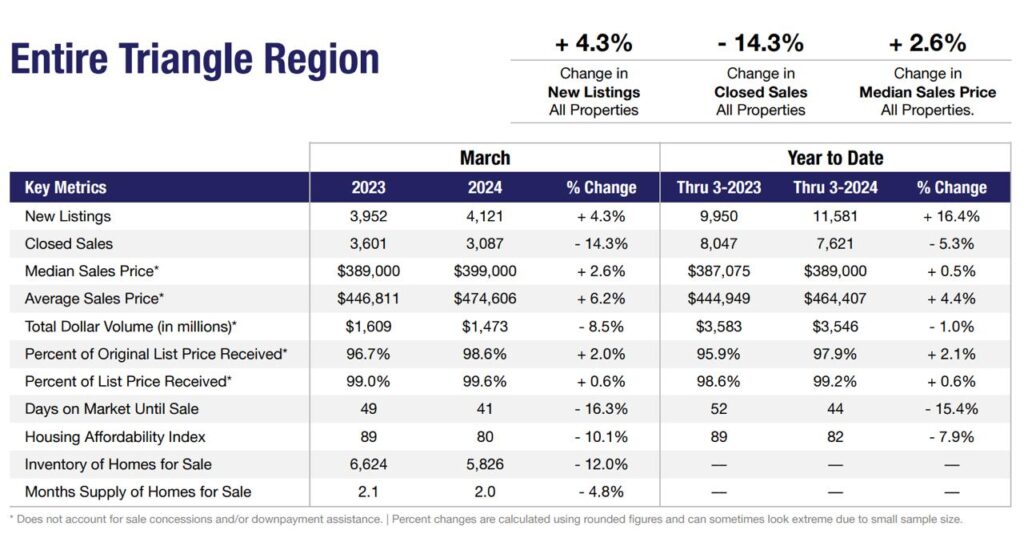

Despite the national data, These real estate metrics paint a picture of a highly competitive market favoring sellers in the Triangle Area.

The monthly supply of Inventory at 2% indicates a shortage of available homes for sale, which typically leads to increased competition among buyers and a higher likelihood of homes selling quickly. The 12-month Change in Months of Inventory decreasing by 12% further confirms this trend, showing that the market has become even more competitive over the past year.

With a Median Days Homes are On the Market at less than 16.3%, it is clear that homes are selling quickly once they are listed. This may be attributed to the high List to Sold Price Percentage of more than 99.6%, indicating that sellers are often receiving their asking price or above.

The Median Sold Price of $399,000 suggests that prices are relatively high in this market, likely due to the high demand and limited supply of homes. Overall, these metrics point to a market that is favorable for sellers, with homes selling quickly and at or above the asking price. Buyers should be prepared to act fast and potentially pay a premium to secure a home in this competitive market. Sellers, on the other hand, can expect to see quick sales and strong offers on their properties.

Brazoban Realty Group: Your Trusted Partner

At Brazoban Realty Group, we’re committed to keeping you informed and empowered in your real estate journey. Whether you’re buying, selling, or investing, our team is here to provide expert guidance and support every step of the way. Contact us today to learn more and stay ahead in today’s ever-changing housing market.

At Brazoban Realty Group, we’re here to assist you in navigating the dynamic housing market. Leave a comment and subscribe to our newsletter for the latest updates!

Sources-