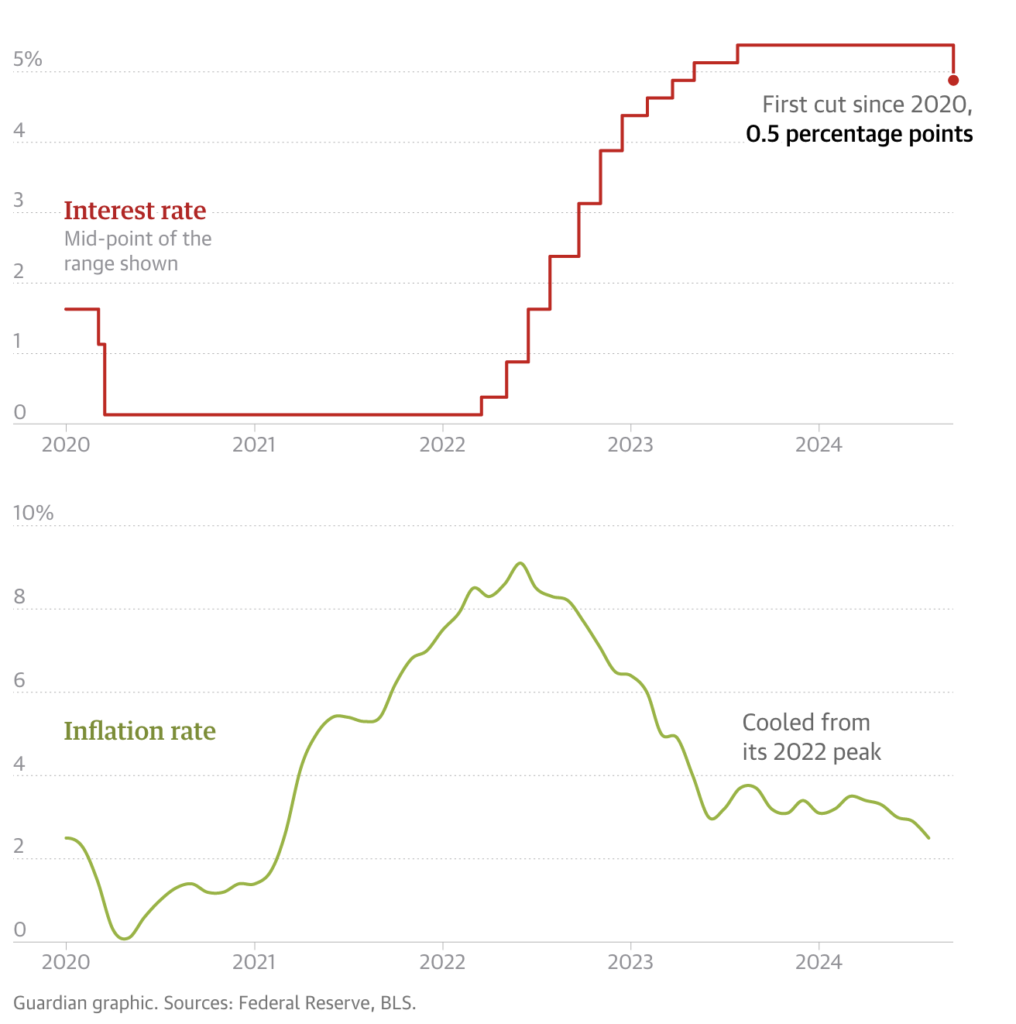

This week, The Fed announced the first rate cut in over four years!

This marks a major adjustment in the market, potentially offering opportunities for buyers to benefit from reduced monthly payments and increased affordability.

Check out this new infographic showing how affordability has improved over the past year.

The Federal Reserve’s recent decision to cut interest rates has significant implications for the housing market. In this article, we’ll explore how these rate cuts are likely to affect homebuyers, sellers, and the overall market.

The Fed’s Rate Cut

The Federal Reserve has lowered its benchmark interest rate by a half-percentage point, marking the first rate cut in over four years. This decision is a response to slowing inflation and concerns about the job market.

Impact on Mortgage Rates

While the Fed’s rate cuts do not directly determine mortgage rates, they have a significant influence. As the Fed lowers its benchmark rate, mortgage rates tend to follow suit. This can make homeownership more affordable for many buyers.

Potential Benefits for Homebuyers

- Lower Monthly Payments: Lower mortgage rates can result in reduced monthly payments, making homeownership more affordable.

- Increased Affordability: Lower rates can make homes more accessible to buyers with smaller down payments or lower incomes.

- Refinancing Opportunities: Existing homeowners may consider refinancing their mortgages to take advantage of lower interest rates and potentially save money on their monthly payments.

Impact on Sellers

Lower mortgage rates can increase demand for homes, potentially leading to higher home prices and faster sales times. Sellers may benefit from increased interest from buyers and stronger offers.

Economic Implications

Lower interest rates can stimulate the overall economy by encouraging borrowing and spending. This can lead to increased economic activity and job growth.

Wrap Up

This is a great sign for the economy! While it isn’t a direct cut on mortgage rates, cuts like this ripple through the economy and the downward descent in home financing is already underway, with rates hitting 2-year lows recently!

So, why should you care?

Lower your payment: We are helping homeowners lower their mortgage payment or shorten their term by refinancing.

Eliminate high interest debt: We are working with homeowners to get out from under high-interest debt with a cash out refinance.

Thinking of buying? Get in early: We are hearing from homebuyers who have been sitting on the sidelines waiting to re-enter the market as rates drop. Get in early before the competition picks up.

Contact Brazoban Realty Group today to learn more about how these rate cuts may affect your home-buying or selling plans. Our team of experienced agents can provide personalized guidance and assistance.

Stay updated with exclusive tips and market insights by subscribing to our weekly newsletter.

Don’t miss out on any price drops or new listings! Sign up for property alerts and save your searches and favorite properties. Begin your real estate search and never miss a great opportunity.

We are looking forward to reading your comments and questions below.

Sources: CORA LEWIS for AP News, The Guardian, Sarah Foster for Bankrate, and Matt Carter for inman