As a trusted real estate professional serving North Carolina’s vibrant local markets, I’m excited to share the latest insights on the recovering mortgage demand and its impact on our housing landscape in May 2025. With increased inventory, shifting buyer behavior, and economic factors like tariffs influencing mortgage rates, the market is evolving. Here’s what you need to know about current trends, how they’ll shape 2025, and actionable steps for buyers and sellers preparing to enter the market.

Mortgage Demand Recovery: A Bright Spot in 2025

Recent data from the Mortgage Bankers Association highlights a second consecutive week of rising mortgage demand in May 2025, despite 30-year fixed mortgage rates climbing to 6.81% for the week ending May 15. This uptick in demand reflects growing buyer confidence, fueled by increased housing inventory and a slight easing of the “rate lock-in” effect, which previously deterred 1.72 million home sales from Q2 2022 to Q4 2024. In North Carolina, this recovery is particularly notable in high-demand areas like Charlotte, where median home prices are projected to rise 3.5% to 4.8% in 2026.

The recovery is driven by several factors:

- Increased Inventory: North Carolina’s market, particularly in Charlotte, has seen a surge in listings, giving buyers more options. For example, Charlotte’s homes are spending an average of 34 days on the market, indicating sustained demand despite higher rates.

- Seller Flexibility: Realtor.com reports that 18% of U.S. home listings in April 2025 had price reductions, the highest April share since 2016. In North Carolina, sellers are increasingly offering concessions, such as covering closing costs or funding temporary rate buydowns, to attract buyers.

- Economic Resilience: Despite tariffs raising concerns about construction costs, North Carolina’s strong job market and population growth continue to bolster housing demand, especially in transit-accessible neighborhoods like South End and NoDa in Charlotte.

Impact on North Carolina’s Real Estate Market

The mortgage demand recovery is reshaping North Carolina’s real estate market in several ways:

- Buyer Opportunities: More inventory and seller concessions are creating a slightly more buyer-friendly market, particularly in areas with higher inventory like Raleigh and Charlotte. Buyers can negotiate better terms, such as lower prices or seller-funded rate buydowns, which reduce monthly payments in the first few years.

- Seller Challenges: While demand remains strong, sellers must price competitively to stand out. Overpriced homes are sitting longer, as noted by Redfin, with some properties in North Carolina lingering due to a “disconnect” between seller expectations and market realities.

- Rental Market Strength: High mortgage rates continue to push first-time buyers toward renting, increasing demand for rental properties. In Charlotte, average rent prices rose 3.5% year-over-year in Q1 2025, benefiting landlords and investors in centrally located neighborhoods.

2025 Outlook: What to Expect

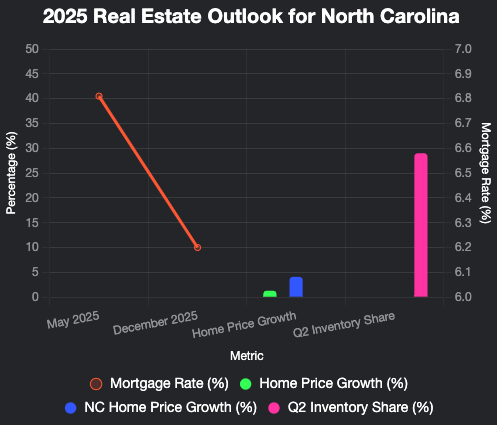

Looking ahead to the rest of 2025, experts predict mortgage rates will hover in the mid-to-high 6% range, with a slight downward trend possible if inflation cools. Fannie Mae forecasts rates dropping to 6.2% by year-end, potentially spurring more buyer activity. However, President Trump’s tariffs could complicate this outlook by increasing construction costs, which may push home prices higher. The Mortgage Bankers Association projects a modest 1.3% home price increase nationally, while Fannie Mae anticipates 4.1%, with North Carolina likely aligning closer to the higher end due to its robust growth.

Key trends to watch in North Carolina:

- Inventory Growth: Housing inventory is expected to rise through Q2 2025, with 29% of yearly home sales occurring between April and June, per NAR data. This could give buyers more leverage, especially in less competitive markets like Durham.

- Affordability Pressures: High rates and prices will continue to challenge affordability, particularly for first-time buyers. Areas like Charlotte, with a median asking price of $408,663, remain competitive but offer opportunities for strategic buyers.

- Policy Impacts: Tariffs and economic uncertainty, including potential job losses, may temper demand in some markets. However, North Carolina’s economic stability should mitigate severe slowdowns.

How Buyers Should Prepare

For buyers looking to capitalize on the recovering mortgage demand and increased inventory, preparation is key:

- Get Pre-Approved: Secure a mortgage pre-approval (not just pre-qualification) to strengthen your offer and understand your budget. Compare rates from at least three lenders, as Zillow research shows 45% of first-time buyers who shop multiple lenders secure better rates.

- Explore Loan Options: Consider FHA loans (requiring credit scores as low as 580) or USDA loans for rural areas, which offer below-market rates and lower down payments.

- Work with a Local Agent: Partner with an experienced North Carolina real estate agent who can access “coming soon” listings and negotiate seller concessions, such as rate buydowns or closing cost assistance.

- Act Quickly: In competitive markets like Charlotte’s South End or Raleigh, be prepared to close quickly to avoid losing out to other buyers.

How Sellers Should Pivot

Sellers can navigate the evolving market by adopting strategic approaches:

- Price Competitively: Work with your agent to set a realistic listing price based on recent comps. Overpricing can lead to longer days on market, as seen in some North Carolina listings.

- Offer Concessions: Sweeten the deal with seller-funded rate buydowns or contributions toward closing costs to attract buyers facing affordability challenges.

- Enhance Appeal: Invest in minor repairs and staging to make your home stand out. Spring’s favorable weather in North Carolina encourages more open house traffic, so capitalize on this seasonal boost.

- Be Flexible: Be open to negotiating terms, such as covering repair costs or waiving contingencies, to close deals faster.

Conclusion: Seize the Opportunity in 2025

The recovering mortgage demand in North Carolina signals a dynamic market in 2025, with opportunities for both buyers and sellers. Buyers can leverage increased inventory and seller concessions to find their dream home, while sellers can attract buyers with competitive pricing and creative incentives. By staying informed and working with a local real estate expert, you can navigate this evolving landscape with confidence.

Stay Ahead of the Market: Sign up for our weekly newsletter for the latest North Carolina real estate updates, market trends, and expert tips delivered straight to your inbox. Don’t miss out—join our community today!

References

- Mortgage Bankers Association, May 2025 Mortgage Demand Report

- Realtor.com, April 2025 Housing Market Analysis

- Freddie Mac, Weekly Mortgage Rate Survey, May 15, 2025

- Fannie Mae, 2025 Mortgage Rate Forecast, April 11, 2025

- National Association of Realtors, Q2 2025 Housing Market Outlook

- The Luxury Playbook, Charlotte Real Estate Market Overview & Forecast, April 26, 2025

- Redfin, March 2025 Housing Market Update